Improper Asset Allocation

Overview

Improper asset allocation refers to the percentage of an investor’s capital spread across different investment classes. Misallocation can give rise to a FINRA arbitration claim. There are many investment classes. Some common examples include stocks; bonds and/or fixed income investments; commodities; real estate; alternative investments; and cash.

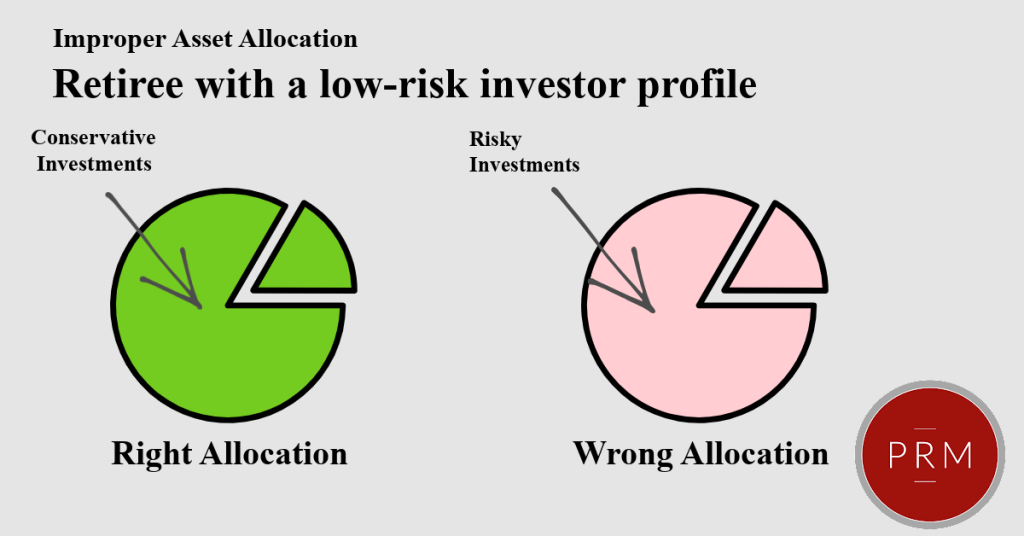

- Investment objective,

- Risk tolerance,

- Time horizon, and

- Specific financial circumstances.

Examples of an Improper Asset Allocation

Example:

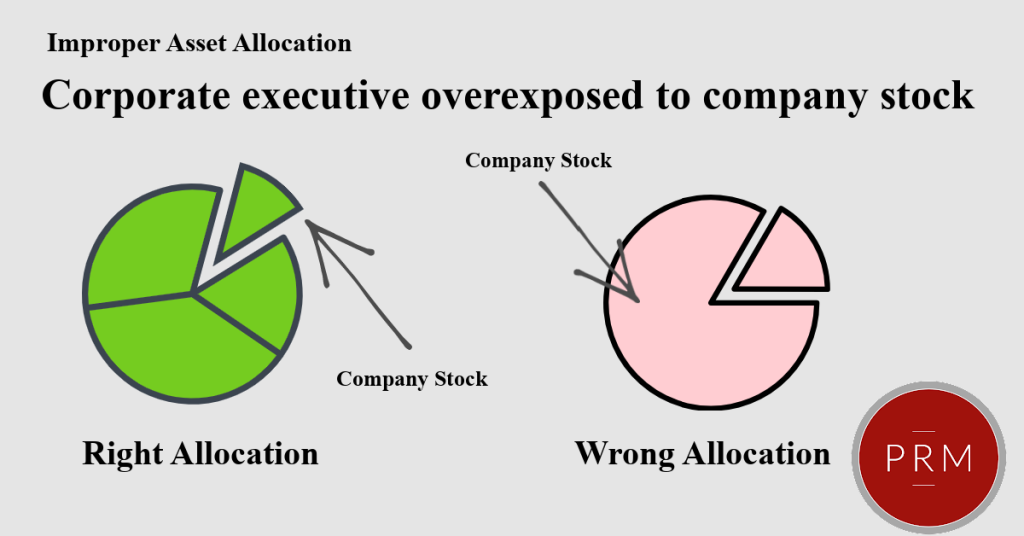

Example:

Suppose a corporate executive receives a windfall of company stock as part of a bonus. The windfall of stock becomes the primary asset held in the executive’s portfolio. Here, the broker-dealer should recommend to diversify the portfolio in other asset classes. That way, the performance of the portfolio does not hinge on the performance of the company stock.

If you believe that your portfolio has been allocated inconsistent with your investment objectives, risk tolerance and investment goals, you should content a professional to assess your specific situation.

*The Law Offices of Patrick R. Mahoney is a full service law firm with extensive experience litigating cases involving a host of securities-related issues. This page is for information purposes only and does not constitute legal advice, nor is it a comprehensive explanation of all improper asset allocation issues. If you believe you have a claim, you should speak to competent counsel to better understand your options. Or, contact us.*