Breach of Fiduciary Duty

What is a Fiduciary?

Financial Advisors and Broker-Dealers Owe a Fiduciary Duty to their Investor Clients.

Most legal authorities consider financial advisors and broker-dealers fiduciaries to their investor clients. That means, financial advisors and broker-dealers must put the investor’s interests before their own. If a financial advisor or broker-dealer fails to use the proper level of care; or fails to make decisions in the best interest of their investor clients, they can potentially be found liable for damages in a FINRA arbitration.

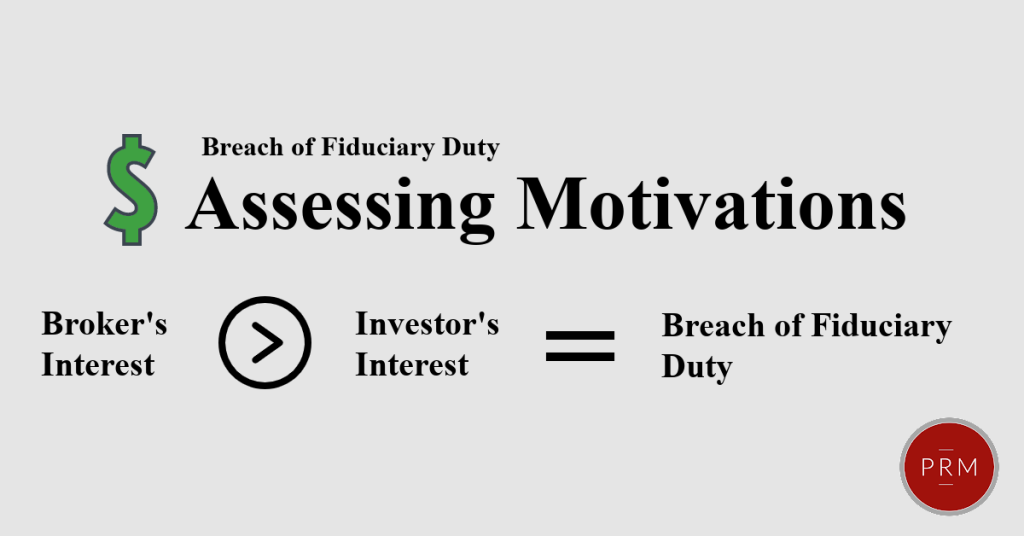

Assessing Motivations can Help Identify a Breach of Fiduciary Duty

One way to identify a breach of fiduciary duty is to weigh the fiduciary’s motivation to recommend something, against the potential benefit to the investor. This often boils down to compensation. How much does the broker or brokerage firm receive in exchange for the investor’s purchase of an investment? Understanding how financial advisors and broker-dealers get paid can help an investor make this assessment.

Examples of Financially Motivated Breaches of Fiduciary Duty

Example:

Example:

Example:

*The Law Offices of Patrick R. Mahoney is a full service law firm with extensive experience litigating cases involving a host of securities-related issues. This page is for information purposes only and does not constitute legal or investments advice; nor is it a comprehensive explanation of all churning of excessive trading issues. If you believe you have a claim, you should speak to competent counsel to better understand your options. Or, contact us.*