FINRA Rule 2080

Expungement of FINRA Customer Disputes

FINRA rule 2080, FINRA Rule 12805, and FINRA rule 13805 govern the FINRA expungement process. This page covers the nuances of these rules and the procedures they call for.

(EDITOR’S NOTE: The FINRA expungement rules are changing. Soon, it will be even more difficult to remove meritless disclosures from BrokerCheck.)

CONTACT US TO ASSESS YOUR EXPUNGEMENT CASE

Rule 2080- The “Expungement Rule”

Rule 2080 represents the primary rule that governs expungement relief requests of investor complaint information from the Central Registration Depository CRD. The central registration depository CRD populates the public information available about the customer dispute on BrokerCheck through filing the U4 Form and Form U5. Broker-dealers and brokers must report customer complaint information as part of their reporting obligations under FINRA Rule 4530.

(Please review our BrokerCheck “How-to” Guide for instruction on using this online tool.)

Rule 2080 provides 3 primary grounds to satisfy a request for expungement relief. The standards to expunge customer dispute information are as follows:

Rule 2080 provides three general criteria that parties requesting expungement relief may establish.

If the financial advisor can establish that the underlying customer complaint is factually impossible or clearly erroneous, an arbitration panel may grant expungement relief.

Example:

Suppose an investor complains that a broker sold him an unsuitable annuity. But the broker did not maintain the insurance license necessary to sell annuities, and therefore couldn’t sell them even if he wanted to. The broker’s inability to sell annuities at all makes the customer’s claim both “factually impossible” and “clearly erroneous,” (assuming the broker did not engage in selling away). This qualifies the broker for expungement relief.

If the financial advisor can demonstrate a lack of involvement in the, “alleged investment-related sales practice violation, forgery, theft, misappropriation or conversion of funds,” an arbitration panel, following an evidentiary hearing, may order removal of the customer complaint from a financial advisor’s record.

Example:

Suppose a client complains that broker JON DOE breached his fiduciary duty owed to him because Jon failed to disclose a substantial commission that the customer paid. The complaint becomes a formal disclosure on Jon Doe’s BrokerCheck report. As it turns out, the broker who actually failed to disclose the commission was unnamed broker named JIM DOE. And the investor simply got the names confused.

In this example, Jon Doe may have the customer dispute information removed after an expungement request because he can prove that he was not involved in the alleged misconduct.

If a broker can prove that the customer’s complaint is false, an arbitration panel may grant an expungement request.

Example:

Suppose an investor complains that his financial advisors churned and excessively traded his account. As a result, the investor claims he paid exorbitant commissions on the account, even though the investor’s account was profitable.

But as it turns out, the account was fee-based as opposed to commission-based. Therefore, the client was not charged commissions, but a reasonable annual fee tied to the assets in the account. Moreover, the investor signed new account forms confirming his understanding that the account charged a fee and not commissions. The financial advisors request expungement.

In this example, the investor’s complaint is false and the panel could rule in favor of the broker requesting expungement..

Rule 2080 also provides a “catch all” to enable arbitrators to grant an expungement request, following an evidentiary hearing, even where none of the three standards above are present.

If an arbitration award containing expungement relief is based on something different than the standards described above, FINRA maintains discretion–in extraordinary circumstances–to grant the expunge request, but only if:

- The financial advisor is meritorious in defending the customer dispute information and/or the underlying customer arbitration; and

- Granting the expungement request to the party seeking expungement, would have, “no material adverse effect on investor protection, the integrity of the CRD system or regulatory requirements.”

Notably, even though this “catchall” to an expungement request exists, in practice, it’s not often used as the basis for expungement in an arbitration award. Indeed, virtually all expungement requests involving customer dispute information, or an underlying customer arbitration, fit into one of the three primary grounds.

Consider the following example of how the alternative standard might be used in expungement requests:

Suppose an investor files an underlying customer arbitration and names two financial advisors as respondents. The underlying customer arbitration alleges that the brokers engaged in securities fraud, churning and financial abuse:

The brokers win the underlying customer arbitration (meaning the investor loses the case), and the brokers request expungement. The arbitrators grant expungement in the award. And in their written explanation they write the investor’s testimony lacked credibility and cite the fact that investors suffered no financial losses or damages.

Technically, the basis for for granting the expungement request had no relationship to the traditional expungement standards (falsity, lack of involvement, or impossibility/erroneousness). But the underlying judicial or arbitral findings were in the brokers’ favor (i.e. the brokers won the case). And so long as FINRA determines that granting the expungement request would have “no material adverse effect on investor protection, the integrity of the CRD system or regulatory requirements…” such expungement relief would be granted.

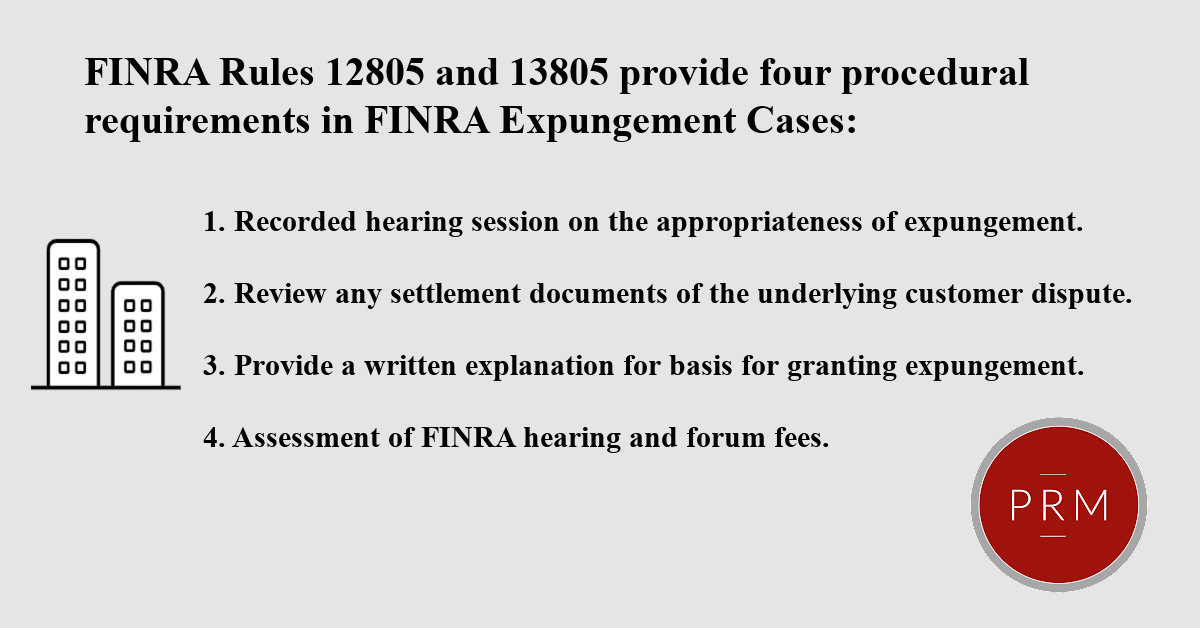

Rules 12805 and 13805 Detail Procedures Arbitrators Must Follow Before Recommending Expungement of customer dispute information

FINRA rules 12805 and 13805 cover the expungement hearing procedures and arbitration procedure in customer and industry disputes. The language in both rules is identical. But one rule covers the industry code (i.e. the rules that apply in cases involving disputes between brokerage firms and individual brokers and/or financial advisors), while the other covers the customer code (i.e. the rules that apply in cases involving disputes between the financial services industry and customers).

The rules layout four requirements/considerations to establish proper expungement hearing procedures.

-

There must be a “recorded hearing session regarding the appropriateness of expungement [of customer dispute information].”

Expungement hearing sessions can be in person, telephonic, or via videoconference. Evidentiary hearing via video conference has become more popular. Opening and closing arguments and overall case presentation has become easier via videoconference post pandemic.

-

In cases involving settlements, the arbitrators must “review settlement documents and consider the amount of payments to any party and any other terms and conditions of settlement.”

If the underlying dispute settles, and the broker then is seeking expungement in a separate arbitration, the arbitrators must review settlement documents and consider how much money was paid to the customer.

Why does the settlement amount matter?

Consider the following example: Suppose two brokers seek expungement of customer complaint information. The customers alleged in the underlying claim that the brokers placed them in unsuitable investments and demanded $200,000 in damages.

Suppose the case settles for $199,0000. In that instance, the arbitrator at the expungement hearing may use the fact that the case settled for virtually the entire amount of the damages alleged as credible evidence that the customer’s claim was legitimate and should not be expunged.

Comparatively, suppose the underlying claim settles for $1,000–nuisance value to avoid the costs of litigation. In that instance, the arbitrators may use the settlement documents as a factor to the brokers’ benefit in assessing expungement relief, because the settlement amount suggests the claim was meritless.

-

The arbitration award giving the expungement order must provide a brief written explanation for the basis for granting the expungement request.

In typical, non-expungement cases, arbitration procedure does not require an explanation for the basis of the arbitration panel’s decision. But because FINRA view expungement as an extraordinary remedy, the FINRA rules require an explanation in expungement cases to help maintain the integrity of the CRD system.

-

Asses FINRA forum fees and hearing fees.

The FINRA rules give broad discretion for arbitrators to assess fees in cases seeking expungement. But typically, in expungement only hearings, arbitrators assess fees on the party seeking expungement.

Role of Arbitrators in Expungement Cases

A panel of three arbitrators in cases involving expungement serve as judge, jury, and executioner in deciding the outcome. These arbitrators have completed enhanced expungement training. The oversee rule 2080 hearings, opening and closing arguments, help enforce FINRA rules and all other components of the process.

Note that even thought arbitrators serve FINRA, they are not FINRA employees, but get paid for their service (for information on FINRA job opportunities, read our page: FINRA Arbitration Jobs.)

For more information on the role of arbitrators in expungement cases, read our primer on the expungement process: FINRA Expungement of Customer Dispute Information.

Settlement Payments and Prohibited Conditions Relating to Expungement of Customer Dispute Information

Customers may not settle any underlying customer disputes on the condition that the customer agree not to oppose any subsequent expungement request.

This rule supports FINRA’s position that customers should not be dissuaded from attending, and opposing brokers’ attempts to seek expungement.

Importance of Allowing Customers and their Counsel to Participate in the Expungement Hearing

FINRA encourages customer participation in rule 2080 expungement hearings. FINRA works to ensure FINRA rules are enforced, and maintains that expungement of customer dispute information is an extraordinary remedy. For that reason, FINRA has gone to great lengths through regulatory notices and proposed rule changes to reiterate the importance that arbitrators place on encouraging customer participation to oppose parties’ efforts in seeking expungement.

Parties Making Second Requests for Expungement

Brokers must attest before seeking expungement through rule 2080, that they have not previously sought expungement of the same underlying customer dispute or arbitration claim.

This attestation also helps FINRA to ensure that no court previously denied expungement of the same customer dispute information.

Multiple expungement requests for the same underlying customer complaints represents one of the reasons why FINRA requires judicial confirmation and an expungement order from a court of competent jurisdiction directing FINRA to formally expunge customer dispute information.